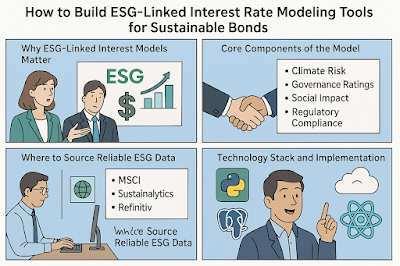

How to Build ESG-Linked Interest Rate Modeling Tools for Sustainable Bonds

How to Build ESG-Linked Interest Rate Modeling Tools for Sustainable Bonds

Table of Contents

- Why ESG-Linked Interest Models Matter

- Core Components of the Model

- Where to Source Reliable ESG Data

- Technology Stack and Implementation

- Real-World Use Cases

🌱 Why ESG-Linked Interest Models Matter

As climate risk becomes a systemic financial threat, investors are turning to sustainable bonds.

These bonds often include interest rates tied to ESG performance metrics.

ESG-linked modeling tools help issuers and investors accurately price bonds based on ethical and environmental impact.

This adds accountability, aligns incentives, and improves transparency in green finance.

🔧 Core Components of the Model

A robust ESG-linked interest model integrates multiple factors:

✔ Climate risk scores

✔ Governance ratings

✔ Social impact performance

✔ Regulatory compliance indicators

These metrics influence spread adjustments in the bond's interest rate structure.

📊 Where to Source Reliable ESG Data

Data quality is critical for accurate modeling.

Some reliable sources include:

🌍 [MSCI ESG Ratings](https://www.msci.com/our-solutions/esg-investing/esg-ratings)

📈 [Sustainalytics ESG Risk Ratings](https://www.morningstar.com/products/sustainalytics)

🏢 [Refinitiv ESG Data](https://www.lseg.com/en/data-analytics/sustainable-finance)

You can integrate this data into your tool using APIs and automate updates via cron jobs.

💻 Technology Stack and Implementation

Popular tech stacks include:

✔ Python for data handling and regression modeling

✔ PostgreSQL for storing ESG time series data

✔ React or Streamlit for user interfaces

✔ Cloud platforms like AWS or Azure for scalability

Regression models (e.g., multivariate linear) or ML models (e.g., random forest) are commonly used.

📘 Real-World Use Cases

Banks use these models to issue sustainability-linked loans (SLLs) with variable rates.

Institutional investors use them to screen bonds aligned with ESG mandates.

Public sector institutions use them to forecast yield under climate regulation scenarios.

🔗 Useful ESG & Finance Resources

Check these insightful posts for related tools and ESG strategy models:

Learn how to predict climate-driven risk across portfolios.

Understand how AI can bridge financial access gaps.

Explore digital twin modeling in sustainable infrastructure.

Use AI to detect contract compliance failures tied to ESG covenants.

Build models for water risk in bond pricing and ESG disclosures.

Keywords: ESG interest modeling, sustainable bond pricing, green finance, climate-linked securities, financial modeling